life insurance face amount decrease

As a life insurance policy it represents a contract between the insured and insurer that as long. Phelan Insurance Agency Inc.

/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)

Variable Life Vs Variable Universal What S The Difference

Most insurers will allow you to decrease the face value of your policy once and in turn lower your premiums.

/dotdash-090816-cash-value-vs-surrender-value-what-difference-final-b2df392375e34caf9eac4e7bc2648283.jpg)

. Many forms of life insurance term and whole life allow for increasing and decreasing death benefit amounts. Typically for a key man policy the term is tied to a specific date such as the employees expected retirement or a projected timeline like the amount of. A life insurance policy can help you give your family financial peace of mind if you are no longer there to provide for them.

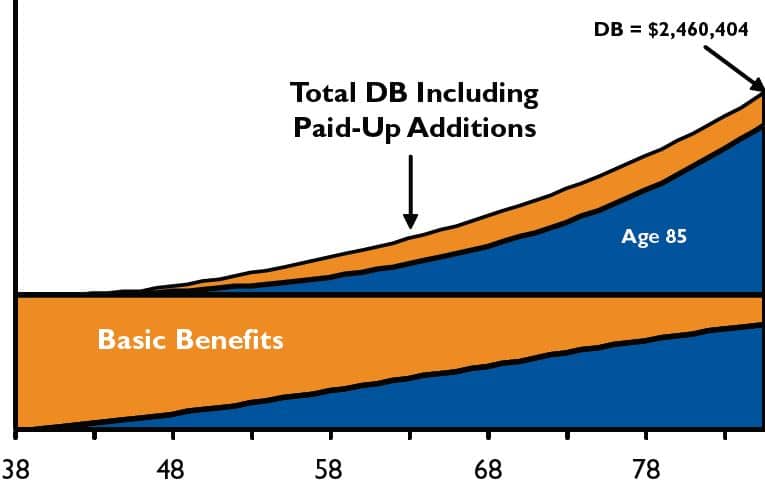

Universal life insurance policy is a type of permanent life insurance policy that offers more flexibility than whole life coverage. Affordable life insurance protection that meets your needs today with flexibility for future needs. If loans are taken on these benefits the payable amount will decrease.

As an example a consumer may purchase a whole life insurance policy with a 100000 Face amount. Life insurance policies will normally pay for losses arising from. The amount of income your family needs should decrease as your familys financial needs dissipate.

D A loan can be taken out for up to the face amount of the policy. The face amount is the initial amount of money which is stated on the face of the contract that will be paid in a death claim. Your full benefit is guaranteed not to decrease before you turn 70.

Insurance in this amount allows for a sustained income of 40000 per year for your family. The life insurance amount needed to sustain your spouses current standard of living is 800000. Phelan Insurance Agency Inc.

Adjustable life insurance is a term and whole life hybrid insurance plan that allows policyholders the option to adjust policy features. Is one of the most trusted insurance agencies in Ohio and serving the Midwest including Indiana and Kentucky. The basis is the money youve contributed to the cash value via your premiums.

More Term Life Insurance. Get a free quote today. Then at age 70 when your need for life insurance has decreased the benefit amount reduces to half the initial amount and at age 75 to 10 of the initial amount.

Face Amount The amount of insurance that an individual buys. If you were to die near the start of the policy term your dependents would receive more than near the end when theres less mortgage to pay off. RIVERSOURCE LIFE INSURANCE COMPANY Fixed deferred annuity account balances declined 4 to 75 billion as of March 31 2022 compared to the prior year period as policies continue to lapse and the.

Whole life insurance or whole of life assurance in the Commonwealth of Nations sometimes called straight life or ordinary life is a life insurance policy which is guaranteed to remain in force for the insureds entire lifetime provided required premiums are paid or to the maturity date. A face value death. The level premium period may be extended beyond the initial level benefit period however the face amount will begin to decrease annually until it reaches 10000 at which point premiums will begin to increase.

The Face Amount will be listed in the policy contract. Term life insurance. Also known as mortgage life insurance its designed to cover debts that decrease over time - like your mortgage.

Term life insurance provides coverage for a predetermined amount of time such as 10 or 20 years and is significantly less expensive than permanent life insurance. The amount of the benefit might also increase if there are more benefits payable when certain conditions are met. The face amount and thereby the death benefit can change for a number of reasons but it is much more difficult to increase a death benefit substantially than to decrease it in most circumstances.

So the amount paid out by the policy reduces with time. Weve found that the average cost of life insurance is about 147 per month for a term life insurance policy lasting 20 years and providing a death benefit of 500000. The beneficiary receives the face amount of the policy upon death.

However if the cash value grows to equal your death benefit amount by the time youre a set age usually 100 or 120 your insurer will terminate your policy and pay out the coverage amount. As an Independent Insurance Agency we are able to search for the absolute best coverage at the best price for your needs from the trusted insurance companies we carry. A Net death benefit will be reduced if the loan is not repaid.

In these instances the cash value would remain with the. You should think of this number strictly as a baseline your own rates for life insurance will change depending on your age the insurer you choose and the amount of coverage. You can increase or decrease the death benefit as your life circumstances change.

Uses Types Benefits and More. Explore five key life insurance types understand their differences and find the one thats right for you and your family. A life insurance application is a legally.

The Face Amount will be paid in the event of the policyholders death or when the policy. Adjustable life insurance is a type of life insurance that combines features of term and whole life coverage giving policyholders the option to. The offset eliminates the need to calculate for.

Choose from 25000 to 500000 of term life insurance at exclusive historically lowest NEA-member rates. Your cash value surrender might be taxed if the amount is larger than the cost basis of the policy. A commercial aviation B war C suicide D hazardous jobs.

:max_bytes(150000):strip_icc()/lifeinsurance-v32-8e01fd19793a49699e47973cfdf98f3d.png)

Life Insurance Guide To Policies And Companies

Northwestern Mutual Life Insurance Review Best For Smokers Valuepenguin

/dotdash-090816-cash-value-vs-surrender-value-what-difference-final-b2df392375e34caf9eac4e7bc2648283.jpg)

Cash Value Vs Surrender Value What S The Difference

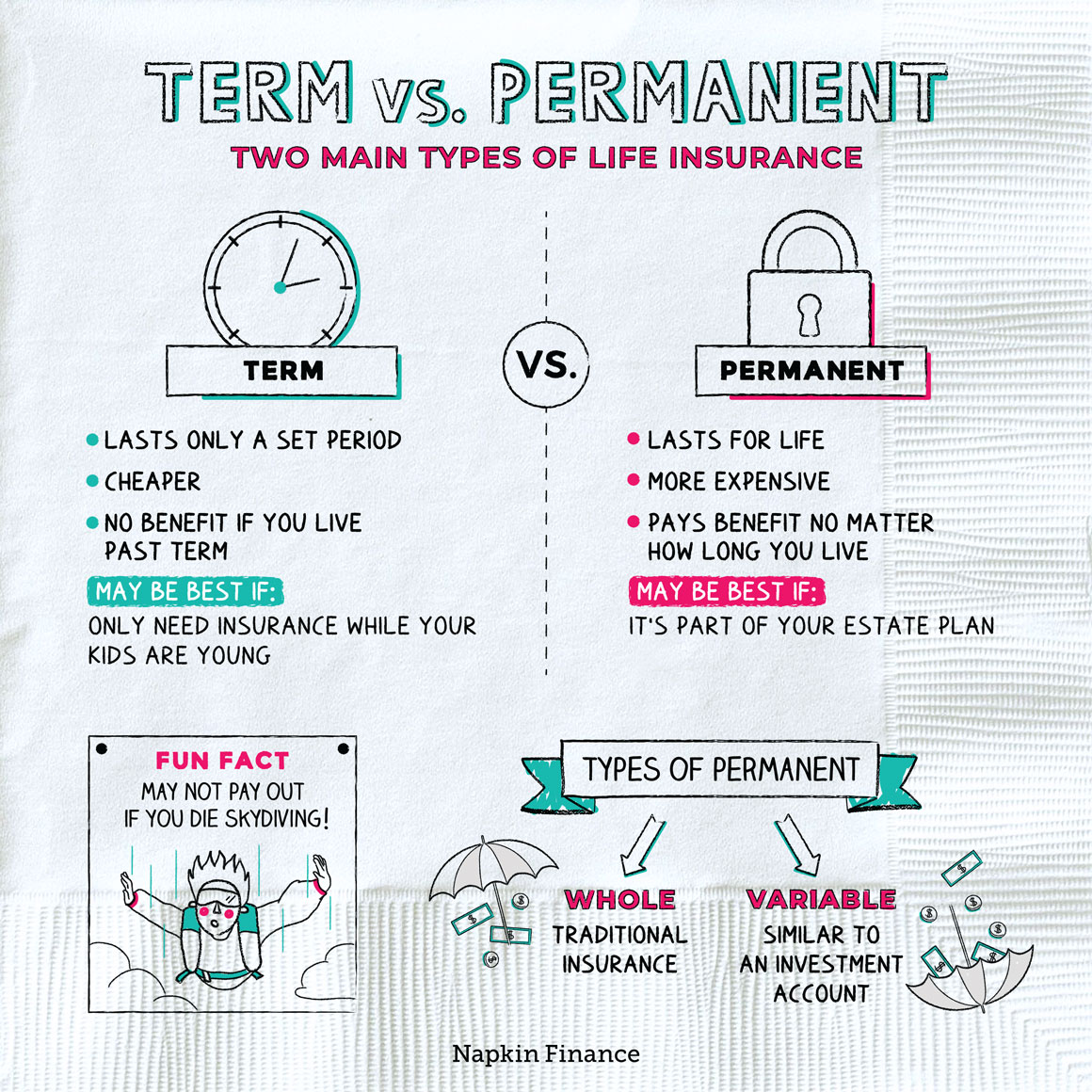

Term Vs Permanent Life Insurance Napkin Finance

Glossary Of Life Insurance Terms Smartasset Com

Aarp Term Life Insurance Rates By Age Chart 2022 Policymutual Com

Term Vs Permanent Life Insurance Napkin Finance

Top 10 Pros And Cons Of Variable Universal Life Insurance

/dotdash-090816-cash-value-vs-surrender-value-what-difference-final-b2df392375e34caf9eac4e7bc2648283.jpg)

Cash Value Vs Surrender Value What S The Difference

New York Life Insurance Review Whole And Universal Life Valuepenguin

Indexed Universal Life Insurance 2022 Definitive Guide

How To Lower Your Life Insurance Premium

What Is Whole Life Insurance Cost Types Faqs

Aig Life Insurance Review Great Rates For Term Whole Life Valuepenguin

What Is Reduced Paid Up Insurance Rpu One Of Whole Life S Non Forfeiture Options Banking Truths

Annuity Vs Life Insurance Similar Contracts Different Goals

/GettyImages-1134608493-a72c93c4adc34ee3b5a1c6e54dffa379.jpg)

Whole Life Insurance Definition